Securing Energy Storage Revenue: The Core Capabilities That Matter

-

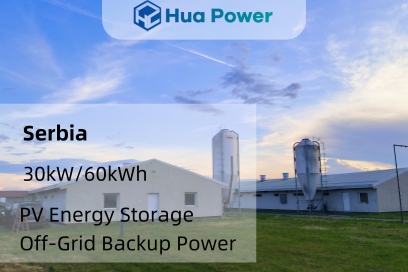

Source:Hua Power

-

Time: 2025-09-15

-

Author:Hua Power

-

Views:217

In today's fast-evolving energy storage industry, revenue certainty is the foundation of project success. Market volatility, shifting regulations, and rapid technological change make it essential for developers, investors, and operators to master the key capabilities that safeguard returns.

Hua Power has been dedicated to energy storage innovation for years, combining global insight with proven expertise. By embedding core capabilities into our solutions, we help customers around the world turn uncertainty into opportunity.

What Shapes Energy Storage Revenue?

Revenue streams in energy storage are primarily determined by two factors: electricity price fluctuations and charge–discharge strategies. This principle holds true worldwide.

- China: In regions with large peak–valley price gaps, storage systems capture value through “charge low, discharge high” strategies.

- Europe: Markets such as Germany are shaped by renewable output fluctuations, while Italy offers fixed-income mechanisms like MACSE.

- North America: Diverse state-level energy policies create varying opportunities and risks.

- Middle East: Countries like Saudi Arabia drive storage demand by mandating renewable-plus-storage deployment.

A mismatch between market dynamics and operational strategy can directly erode profitability.

Four Core Capabilities to Secure Returns

1. Price Foresight

Accurate forecasting of price movements is critical to seizing arbitrage opportunities. Hua Power's global market teams specialize in:

- Tracking supply, demand, and regulatory signals in China.

- Analyzing renewable output curves and policy cycles in Europe.

- Monitoring state-level transition roadmaps in North America.

- Evaluating grid capacity and renewable projects in the Middle East.

This market intelligence enables customers to act with confidence.

Source : IEA

2. Smarter Dispatch Strategies

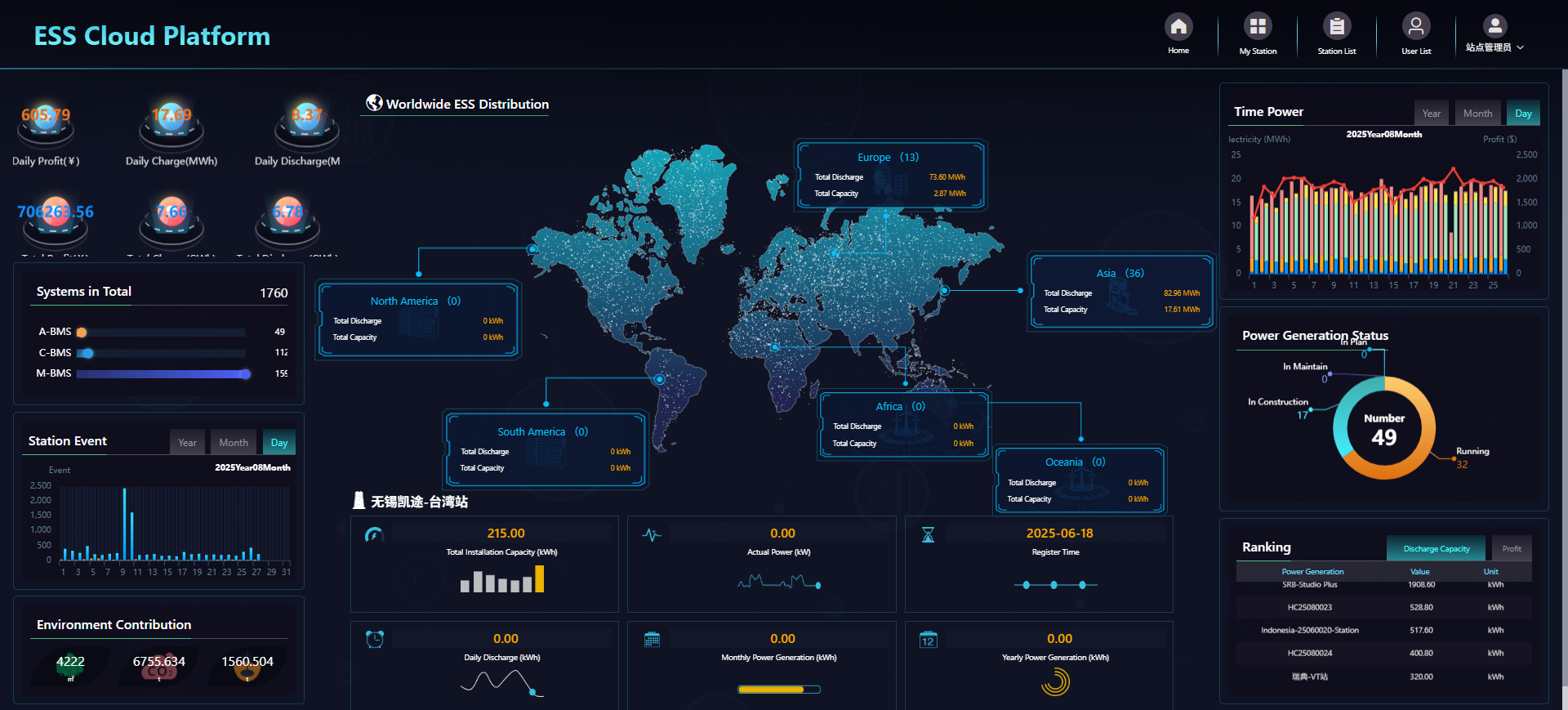

Built on robust forecasting, Hua Power's EMS platform dynamically optimizes dispatch. It adapts to renewable-driven volatility in Germany, spot market dynamics in Italy, frequency regulation in the UK, and peak-shaving needs in Chinese industrial and commercial sites. Its modular design ensures scalability across diverse applications, maximizing value in every market.

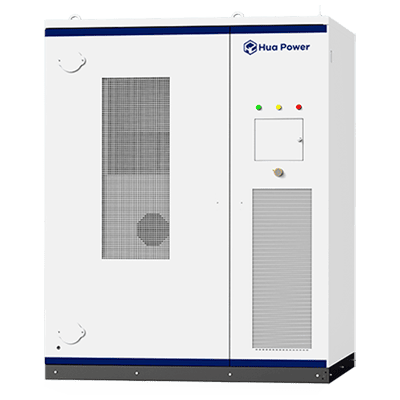

Hua Power ESS Cloud Platform

3. Reliable Integration and O&M

System reliability underpins financial performance. Hua Power integrates world-class components—battery cells, PCS, and control systems—aligned with Chinese standards as well as global certifications such as TÜV (Europe) and UL (U.S.). Intelligent monitoring and remote diagnostics reduce downtime and ensure stable returns for projects from China to Prague, North America, and the Middle East.

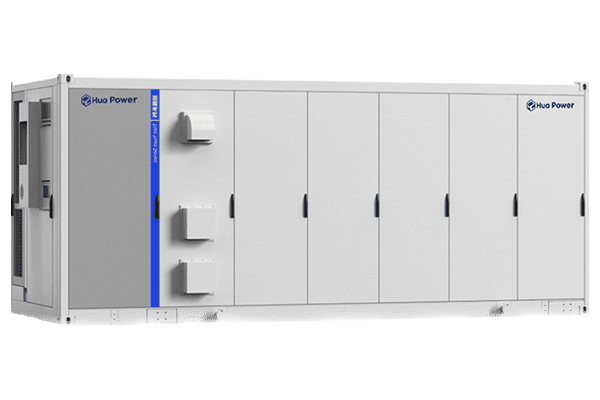

Hua Power 1MW/1.72MWh Liquid Cooling ESS Container

4. Market Participation Flexibility

Every power market has its own rules. Hua Power helps clients unlock multiple revenue streams by enabling:

- Demand response and spot trading in China.

- Ancillary services and capacity markets in Europe.

- State-level participation in North America.

- Renewable-linked storage mechanisms in the Middle East.

Why Hua Power?

With over 200 projects worldwide, Hua Power delivers end-to-end value:

- A modular EMS platform adaptable to any grid or market framework.

- Precision battery management achieving 91% efficiency and near-zero parallel loss.

- One-stop solutions spanning planning through O&M, tailored to local conditions.

.jpg)